Modernize Banking Without Compromising Data

Secure sensitive financial and personal data end-to-end as you accelerate digital transformation and stay audit-ready across key global regulations.

Explore TAMUNIO platformThe Data-Risk Reality for Modern Banks

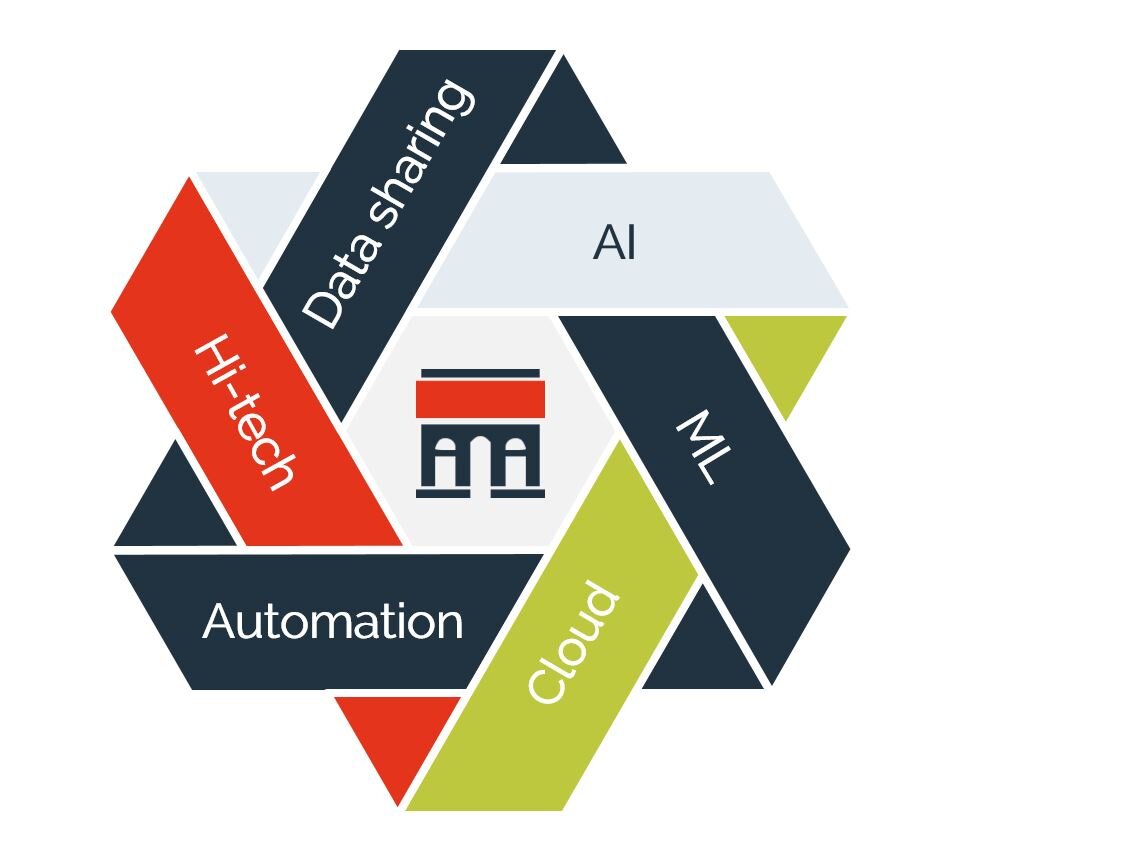

Banking is modernizing at speed. Cores are evolving into services, real-time payments are standard, and cloud and AI are now table stakes. But as sensitive data flows across channels, partners, and regions, the attack surface expands.

Leaders must cut compliance costs, reduce breach risk, and unlock growth all at the same time. When security is bolted on late, these goals collide, creating friction and exposing the business to fines, disruption, and reputational damage.

Banks need an end-to-end strategy that minimizes plaintext exposure, enforces consistent policy, and enables safe use of data for cloud and AI.

Data-Centric Security for Modern Banking Transformation

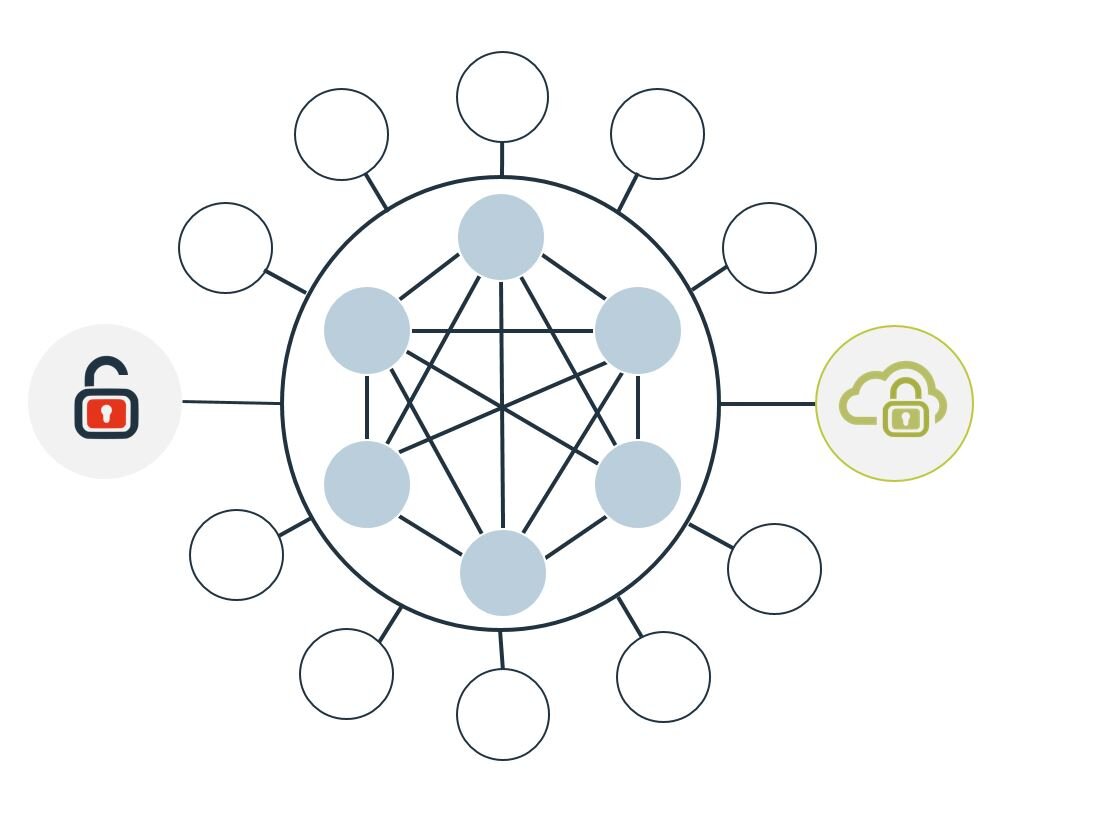

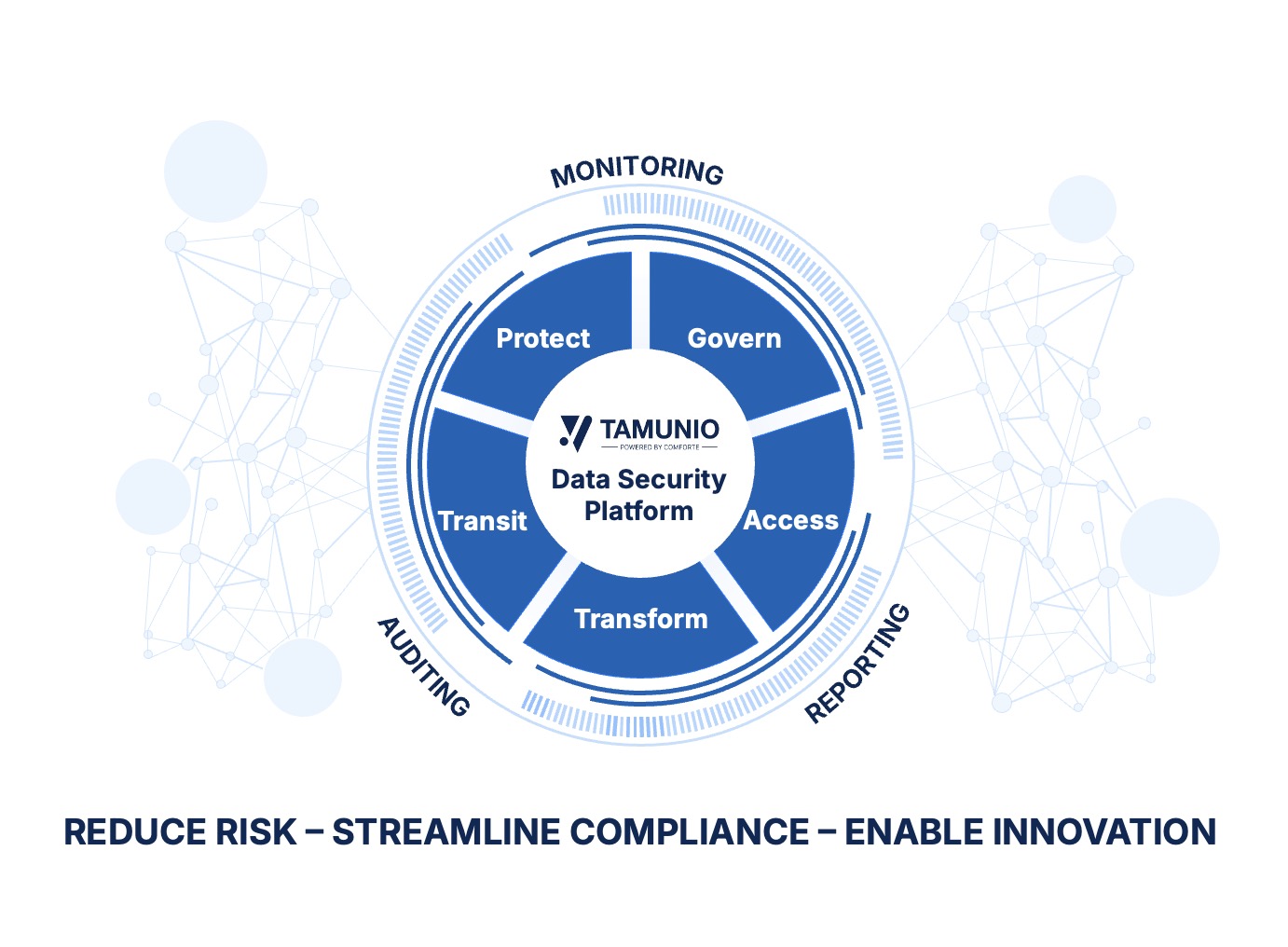

TAMUNIO is comforte’s unified platform that protects the data itself wherever it travels. By taking a data-centric approach, it helps modernization projects move faster by reducing plaintext exposure and centralizing control.

Rather than relying on fragmented tools or perimeter controls, TAMUNIO helps keep sensitive information, account data, and documents protected by default across core, cloud, and AI workflows. As a result, teams can deliver safer digital services, strengthen fraud analytics, reduce data exposure, and unlock new revenue opportunities.

Trusted by the world's leading financial services companies

How TAMUNIO Helps

| What’s Getting in the Way | How TAMUNIO Helps |

|---|---|

| Siloed security & tool sprawl: Point solutions cover layers but leave gaps and drive audit fatigue. | ✔Unify protection: Replace point tools with one platform for consistent security across core, cloud, and partner systems. |

| Regulatory complexity: PCI DSS, DORA/ NIS2, GDPR, and residency rules slow modernization across hybrid estates. | ✔Simplify compliance: Centralized policy, sovereignty controls, and SIEM-ready audit to help accelerate regulatory evidence. |

| Data sprawl across hybrid stacks: Sensitive data scatters across cores, cloud, SaaS, pipelines, and AI. | ✔Automated discovery: AI-driven detection of high-value data (PII, PANs, statements, trading records). |

| Expanding attack surface: Real-time rails, ISO 20022, and open banking widen exposure and insider risk. | ✔Protect everywhere: Secure data at rest and in transit to enable approved use. Minimize plaintext to TAMUNIO’s Data Sovereignty Zones for processing. |

| Plaintext heavy models: "Decrypt to use" expands risk, blocks safe data sharing, and delays AI projects. | ✔Govern centrally: Manage policy, keys, and audits in one place for visibility and control. |

"Comforte AG has been a valuable partner; their expertise has provided us with proven, effective solutions that are compatible with our internal systems and software. We appreciate their partnership, collaboration, and expertise in this area."

Stephanie Stamos, Director, Technology Services at Discover

Thailand’s Government Savings Bank Accelerates Compliance

One of the largest financial institutions in Southeast Asia modernized its data protection strategy across a nationwide footprint.

- Achieved PCI compliance on schedule, meeting central bank mandates

- Secured sensitive information across legacy and modern infrastructure

- Delivered stronger customer assurance while maintaining service levels across thousands of ATMs and 1,000+ branches